[ad_1]

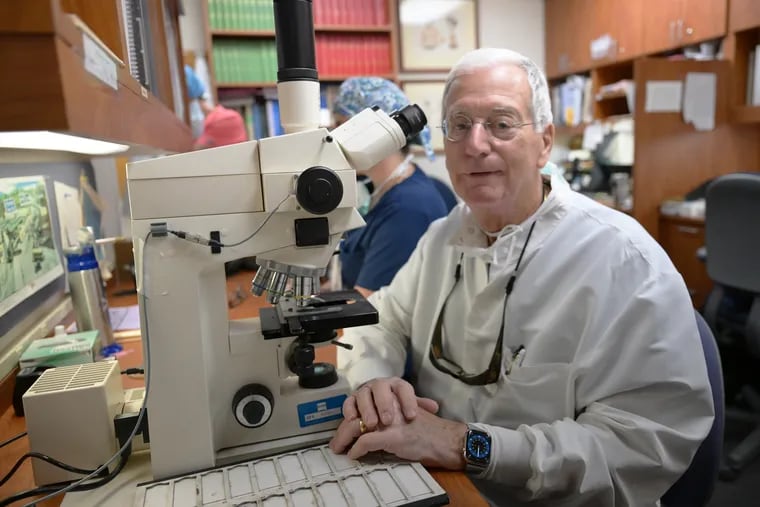

Anthony V. Benedetto, a Drexel Hill dermatologist with an independent practice for more than 40 years, was a holdout in a world where a majority of physicians are employees of health systems or large practices.

In July, Benedetto gave up his independence and sold his practice to a Berks County company called Dermatology Partners, becoming an employee for the first time since he was a kid.

Persistent financial challenges pushed him to make the move, said Benedetto, who is 76 but not ready to retire.

First, a big insurer, in January, started reviewing Benedetto’s claims back to 2021, rejecting some of them. He declined to name the company but said it then began deducting money from current procedures. Then, a cyberattack on the nation’s largest health insurance claims and payment processor, Change Healthcare, in February disrupted payments to doctors, setting him back more than $70,000 — money he still hasn’t recovered.

“We have a nice staff, and we have a nice practice, but I haven’t pulled a paycheck for a month or two because I just can’t keep up. I can’t catch up,” Benedetto said, describing his life earlier this year as an independent physician.

Benedetto talked to a private-equity firm about a possible sale, but decided he did not like the model. Dermatology Partners appealed to him because it has a reputation of being well-run and is owned by a physician, he said.

“They’ve grown into a very strong and efficient group of dermatology practices,” Benedetto said.

Dermatology Partners, based in Amity Township, was founded in 2012 and has 32 practices in Pennsylvania, Delaware, and Maryland. The group has 32 dermatologists, 3 plastic surgeons, and 18 nurse practitioners and physician assistants. It employs more than 400, but does not disclose annual revenue.

Avoiding private equity

Benedetto wanted to avoid selling to a private-equity firm, especially after what he heard from one of them. Private equity firms pool money from investors to acquire businesses, build them into bigger enterprises, and then sell them.

“I was told this by a private equity company that I was entertaining, that their goal was to manage [the practice] for five years and sell it off,” Benedetto said. To him, that meant they were only in it for the money.

Private equity firms control a relatively small slice of the overall health-care market — just 4% of the market by revenue, according to data company PitchBook. But they gained a foothold in dermatology and other specialties in part because many doctors have a hard time passing their practices on to other physicians, experts say.

And when doctors want to get their sweat equity out of their business, their choices are limited, said health care consultant Lynda Mischel, who lives in Merion Station. “Hospitals can’t really pay a premium for equity, but a private equity company can,” she said.

Dermatology Partners offered an alternative model. Its owner is a dermatologist named Daniel Shurman, who cofounded the practice in 2012 and got to know Benedetto during a one-year fellowship in Mohs surgery from 2008 to 2009. That is a way of removing cancer while preserving as much skin as possible.

Shurman and his business partner, Andy Frankel, who is not a physician, said they have no plans to sell Dermatology Partners after it gets to a certain size. “My endgame is to make it as great a practice as we can for as many physicians as we can,” Shurman said. “We have a 13-year plan to continue our growth trajectory that we’ve had for the last 12 years, which is about 20-25%” a year.

Frankel said about two-fifths of the the company’s growth has been through acquisitions like the one that brought Benedetto’s Dermatologic SurgiCenter into the fold. The rest of the growth has come from opening new offices and hiring more dermatologists, he said. Frankel and Shurman co-own a company that provides back-office services for Dermatology Partners’ practices.

Other big dermatology practices in Dermatology Partners’ markets include Schweiger Dermatology, U.S. Dermatology, and Anne Arundel Dermatology, Frankel said. “They’re all private equity, so we don’t really see them as competitors. We see them as the guys we’re going to outlast,” he said.

Financial terms of Dermatology Partners’ deal with Benedetto were not available.

A younger physician’s view

Orr Barak, who has been with Dermatology Partners for 10 years, was not interested in managing his own business after he finished his training in dermatology and dermatopathology in Boston.

“I didn’t feel like I had the tools for management. I also felt like managing an office, managing a company was low-yield when I could be doing medicine — low yield revenue-wise, low yield psychically,” he said.

Working in an academic setting also did not appeal to Orr because the things he liked about academic medicine, such as research and training medical residents, didn’t outweigh the negatives of the bureaucracy. Going to a private-equity-backed firm was a possibility. The pay was high, he said. But he was concerned about the downsides he heard about, such as cost-cutting pressure and outside control.

Working in a practice run by physicians comes with the risk of inefficient management, Orr said. Dermatology Partners kept its promises in terms of growth and allowing him to practice medicine his way.

Good management is crucial in today’s challenging economic environment, he said.

“When reimbursements were very, very high in the past, it didn’t matter how good a business person you were,” Orr said. “You could get by running a practice, but now it’s not as easy to do that, and you need to run things efficiently.”

What changed for Benedetto

Benedetto reflected during an interview on how much has changed in the last few decades. When he started, he effectively had to deal with just two insurers, Blue Cross Blue Shield and Medicare.

“Now they have God knows how many insurance companies, how many hands in the pot, and everybody wants a little piece of us, including computer companies and advertising. It’s just crazy,” he said.

Benedetto was ready for a change, and fortunately, since he became a Dermatology Partners employee on July 1, little has changed in the way he treats patients, he said.

“I practice daily as if nothing happened, except there’s a lot of people around me now,” he said. “I was sort of quietly by myself. Now I have all this support. It’s good support.”

One of the early projects was computerizing Benedetto’s patients’ medical records. That caused “a little roughness,” Benedetto said, but it’s been a relief to have the company take over administration, human resources, and dealing with insurers.

Those are things he used to do on the side, in addition to taking care of patients, “but just got overwhelming.”

[ad_2]

This article was originally published by a www.inquirer.com . Read the Original article here. .